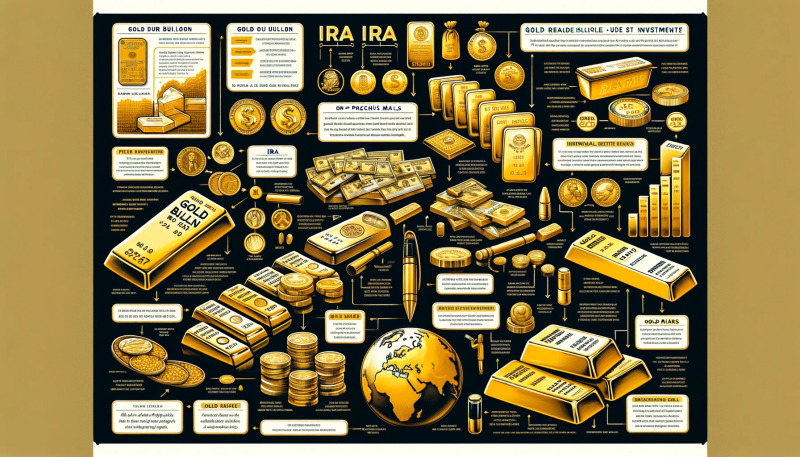

A number of different types of assets can be held in a self-directed individual retirement account (IRA), including certain physical precious metals products.

However, some stipulations apply: Silver coins, for instance, generally must have a fineness of 0.999 or greater to be eligible, and gold bullion coins generally have to possess a fineness of at least 0.995.

While precious metals coins that qualify for inclusion are, by definition, official legal tender, non-legal-tender products like bars or rounds may also be eligible. Of the eligible products widely available, coins tend to draw a large amount of consumer interest. This is because they feature both precious metals content and the potential for additional growth based on factors like grade and rarity.

The American Gold Eagle coin, for example, is a gold bullion coin that has been produced for more than three decades in various weights, denominations, finishes, and designs and made available in various grades and special designations. Struck by the U.S. Mint, the Gold Eagle coin’s weight and purity are backed by a U.S. government guarantee.

While the fineness of American Gold Eagle coins is technically below the standard threshold, the Internal Revenue Service has made a special exception to allow the inclusion of these coins in IRAs.

Rectangular silver and gold bars may also qualify for inclusion in an IRA if they have the required composition. Because gold bars are typically produced at weights between 1 ounce and 1 kilogram and can cost less to produce than gold coins, they may appeal to portfolio holders who are interested in purchasing large amounts of gold while paying a lower premium. However, because gold bars do not tend to generate the same interest as coins on the secondary and collector markets, they may realize less growth potential than gold coins.

Customers Cite Precious Metals’ Diversification Benefits

Gold has a track record of performing well during both economically prosperous and challenging periods — one of the reasons, according to U.S. Money Reserve reviews, some portfolio holders have chosen to purchase the precious metal.

In one of the U.S. Money Reserve reviews shared through the Better Business Bureau, Robert E. calls the company’s assistance in diversifying his portfolio “priceless.”

“The help I received in setting up my precious metals [IRA] was handled well,” Robert says. “[It] makes me sleep comfortably knowing I was able to lock in my life savings.”

Portfolio holder Rich D. looked into three companies when preparing to convert his savings to gold. Ultimately, he chose to work with U.S. Money Reserve.

“As our country and the world [seemed] to be in such turmoil, I knew I had to make a different choice with my savings to protect it,” he says in one of the U.S. Money Reserve reviews available on the Better Business Bureau website. “Gold, I found, is the way.”

Gold, silver, and other bullion coins and bars can be purchased from a reputable precious metals distributor like U.S. Money Reserve, which in the past 22 years has served more than 785,000 clients.

To find out more about obtaining precious metals, call 1-888-356-7074 to speak to a U.S. Money Reserve Account Executive who can provide information about how to set up a self-directed IRA and the company’s current inventory of government-issued bullion coins, high-purity bars, and other assets.