Consider “What is the highest risk score at the moment and how can it be removed?” to quickly improve your rating.

You’ve probably heard this before.Pre-seeds, seeders and A-series, as well as B-series, A-series, and B-series. These labels are often not very useful as they are not easily marked. We’ve seen small Series A rounds and large pre-seed rounds. The key feature of each round is not the amount traded but the risk involved in the company.

Two dynamics are involved in your startup journey. Understanding them and their relationship will help you make sense of your fundraising journey. You’ll also be able to see how you can think about every aspect of your startup’s development and growth.

Funding rounds generally go like this:

- The Four Fs: Friendship, Family, Friendship, Fools This is the first money paid into a company. It is usually enough to prove basic business or technology dynamics. Here the company is trying MVP build. These rounds often include angel investors of different levels of sophistication.

- Pre-seed:It is often confusing to note that this is the same as the previous, except that it is done with an institutional investor (e.g., a family or venture capital firm focused only on early-stage companies). This is usually not a “priced rounds” because the company doesn’t have a formal valuation. However, the money raised is transferred or secured securities. Companies usually don’t generate any revenue at this stage.

- seed:This is usually an institutional investor who invests more money in a company that is showing some signs of dynamism. The startup will have some aspects of its business running. It may have test customers, a product demonstration, and a concierge manager. It will not have any growth drivers (that is, it won’t have a repeatable driving force after attracting and retaining customers). The company is responsible for developing the product and finding the right product for the market. Sometimes the round is priced (for example when investors negotiate a company’s value), or it might be unpriced.

- Series A:This is the company’s initial “growth round.” They have a product on the market that delivers value for customers and are well on their way to having an easy and reliable way to invest in customer acquisition. The company might be looking to expand its product offerings, enter new markets or target a new customer segment. The first round is almost always “priced”, giving the company a formal valuation.

- Series B and Beyond: The company is usually in the lead in Series B. It has clients, revenue, a stable product, or two. From Series B onwards you can have Series D, E, and so forth. The company grows and tours increase. The final rounds are usually used to prepare a company to enter a black market (being profitable), go public via an IPO or both.

Each round increases the company’s value. This is partly because it has a more mature product and more revenue, and it works out the details of its growth and business model. The company is also developing in another way: the risks are decreasing.

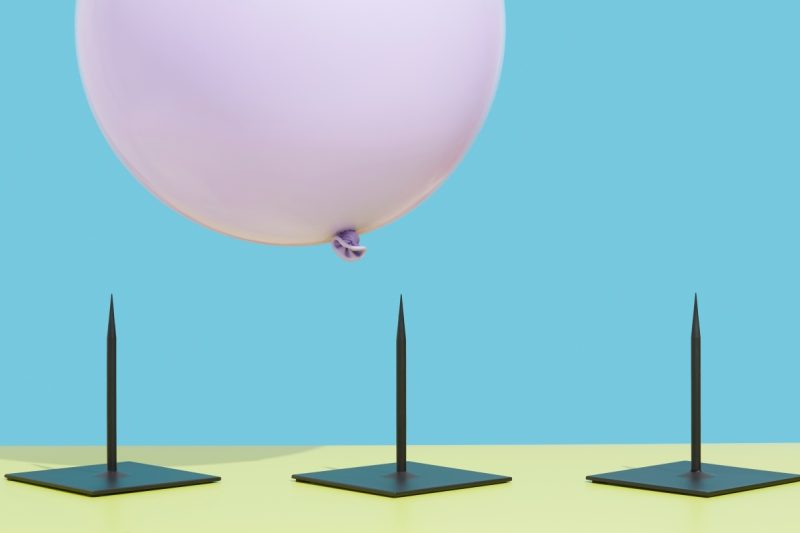

This last point is critical in how you view your fundraising journey. Your company’s value does not mean that your risk is less. A company that reduces its risk is more valuable. This can be used to your advantage if you design your fundraising rounds to specifically exclude the “most terrifying” risks for your company.

Let’s take a closer view at the risks involved in a startup, and what founders can do to reduce them at every stage of their company’s existence.

What are the potential risks for your company?

There are many types of risks. You may meet co-founders when your company is still in its idea stage. They might be a good fit for the market. You’ve identified a problem on the market. Early interviews with potential clients confirm that this is an issue worth solving and that someone would, theoretically, be willing to spend money to solve. The first question to ask is: Is it possible to solve the problem?

Source link

[Denial of responsibility! reporterbyte.com is an automatic aggregator of the all world’s media. In each content, the hyperlink to the primary source is specified. All trademarks belong to their rightful owners, all materials to their authors. If you are the owner of the content and do not want us to publish your materials, please contact us by email – reporterbyte.com The content will be deleted within 24 hours.]