The takeover was more than a year ago $4 million in seed fundingBased in Chile creditA startup business lending company has returned $6 million more in funding.

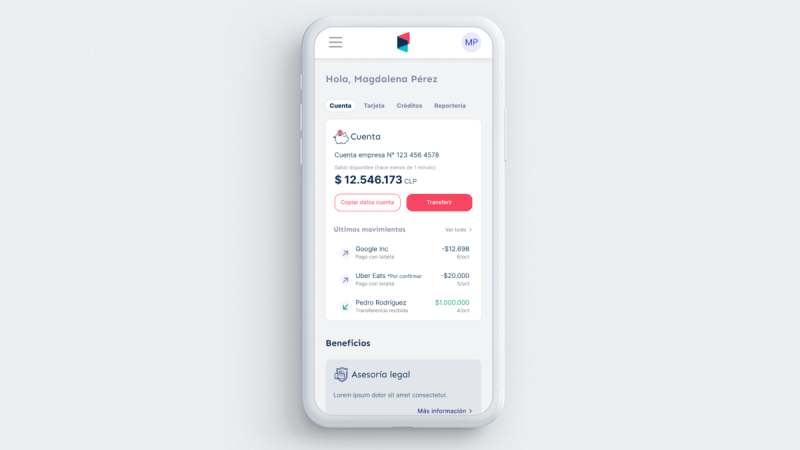

The company went public in 2021. They are partnering with financial institutions to help small companies manage their spending, get unsecured digital loans, open bank accounts, and apply for a business credit card.

Last year, when we profiled Kredito, Sebastian Robles, co-founder, and CEO, told TechCrunch that credit for business doesn’t automatically come with an account. This leaves business owners free to use personal credit cards.

TechCrunch spoke to him recently that everyone wants to sell online so e-commerce capabilities were crucial. “Most of our customers go online, but what has happened is that banks have become more restrictive with their products, making it difficult for the unbanked or underbanked to access decent financial services or even a bank account sometimes.”

Kredito, however, takes on these risks using its proprietary algorithm and other data to assess credit risk faster than traditional banks and in real-time, Robles stated. It has also developed products with low requirements that reduce acquisition costs and collect data from customers about how best to help them access financial services. Robles stated that anyone can use the account and company’s card. The loan product, however, is only available to those who are eligible and shares data with Kredito.

Robles is currently finalizing the debt round and has raised $11.5million in equity and debt. The new capital was raised by a group including family offices and angel investors, including Oskar Hjertonsson and Daniel Undurraga (Centreshop by Uber founders) and other partners from real estate development Patio.

Robles didn’t plan to invest in new capital, but Kredito is growing faster than expected. Robles ran the company very poorly and needed to hire a small team in order to grow.

He stated that the company currently has approximately 100,000 accounts and 5,000 active users. The company is experiencing a 90% monthly revenue growth. They are determined to keep this growth going over the next year, as they continue opening thousands of accounts each month.

Robles plans to use this capital to expand in Chile and fuel its growth. He said exporting Kredito’s product — making sure what it does in Chile can do in other countries — will be key. The company will therefore first work on its IPO, accessing data from multiple countries and iterating on its strategies.

“Internationalization is the main focus,” he added. “We have a lot of work to do. We have made significant progress in underwriting and loans. Now we need to do the same for other products. We’re going to be focusing our efforts on growth domestically. We already have a product that’s market fit and we have a lot of traction, and now we want to grow even more.” .

Source link

[Denial of responsibility! reporterbyte.com is an automatic aggregator of the all world’s media. In each content, the hyperlink to the primary source is specified. All trademarks belong to their rightful owners, all materials to their authors. If you are the owner of the content and do not want us to publish your materials, please contact us by email – reporterbyte.com The content will be deleted within 24 hours.]