You are most welcome to exchange! Thank you for signing up for this email and for your confidence vote. Sign up if you are reading this as a blog post on our site. hereIt will be available for you to pick up at any time. Each week, I’ll be looking at the most recent fintech news. This will include everything from trends to funding rounds to analysis of a space to hot deals about a company or phenomenon. There is a lot of fintech news, and it is my job to keep everyone informed. – Mary Ann

We are glad to wish you a happy new year! It’s been a while since I last wrote this newsletter. It’s been a long time since I wrote it.

Before I get into the news, I want to say that I wish you all a relaxing and enjoyable holiday. Although ours was not great, it wasn’t a bad thing. It took me a while for my brain to get into work mode this week, so bear with me.

Friday was Friday and I published an article in DorstedHe collected $21.5 million in Series B.. This story was a further proof of how popular people are. Is that true benefitTechnology that is related to the real-estate rental market, especially when it comes to investing. Doorstead, for its part, claims it’s more that a full-service property manager company. It also assures homeowners it operates on a minimum rental. If you don’t get the amount promised, you will have to pay the difference. If he gets more, well, the owner gets the raise—not the company. Doorstead claims it deliberately made money by charging an 8% management charge to align its incentives with the homeowners it works alongside. The company claims it can reduce the time that rental properties are vacant by being willing to pay the difference. Ryan, Leani, Jennifer Bronzo, co-founders of the company, stated that homeowners will not only receive a guaranteed rental income but can also rent out their properties quicker and make more money this way. Doorstead also announced that it had purchased the Boston assets of Knox Financial, another proptech firm supported by company funding. uploadI had you covered in 2021. Although I don’t know the reason for the company’s closure, I believe we will see more of this type of activity in 2023. By “kind of thing”, you mean startups receiving assets from other startups. Head to Equity Podcast to hear the Equity Podcast team’s thoughts about the Doorstead model. here.

During the break we posted InterviewConducted with her JGV CapitalRobin Lee and Hans Tung during the fourth quarter. GGV, an investment firm with $9.2 Billion in assets, invests in startups at all stages of their growth, from seed to maturity. It also manages investments in enterprises and cloud-based fintech companies. Tong’s opinion that downhills aren’t the end, is one of the highlights from the interview. Tong said that he would rather see a startup make a downturn than have it go under. And that the end result is what matters. refreshing! He also shared his tips for his portfolio companies. Lee also shared her thoughts about why embedded fintech is still so hot.

Tong predicts more down rounds in 2023. I’m certain there were many in 2022. However, Tong believes that startups that were started in 2021 will become less cash-strapped in 2023. I agree with him that it is not shameful to raise the bottom round. Ratings have been exaggerated, and any relegation rounds this year reflect ratings that are more realistic and easy to defend.

Doorstead founders Ryan Waliany,CEO, and Jennifer Bronzo, COO. Credits for the image: Dorsted

The weekly news

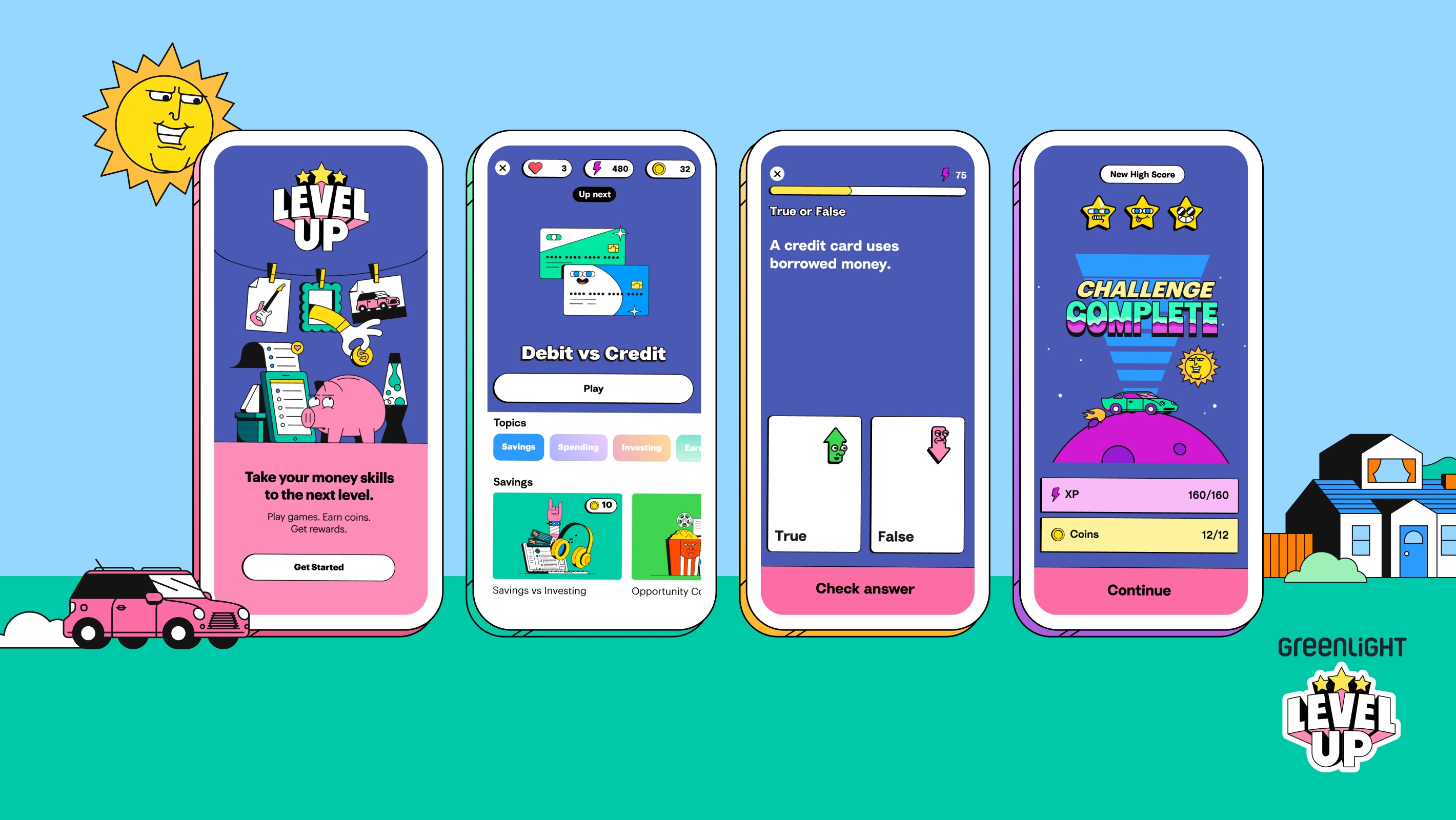

Jan 6th, family fintech was described green lightLaunched Green light upgradeCurriculum-based, interactive financial literacy game. Although the company clearly wants to appeal to the younger generation’s passion for digital games, it is difficult to understand why it didn’t include a game. An email spokesperson told me: “Children can earn virtual coins and experience points and take part in real-world money lessons through dynamic graphics, story-driven gameplay and animations on their mobile phone or tablet – taking gamification and application principles into one of the essential skills they will need all along. “. It is not a new idea to funnel money into games. Last year, I wrote a piece about Truist, the largest financial institution in the country. Acquisition of fintech startup Long GameIts efforts to attract a younger clientele.

Start BaaS SynecteraHe said that she cooperates Single(meaning “one” Arabic), is a digital Islamic investment platform which claims to be the first halal investment app. Synctera provides infrastructure for Wahed to make their services available to the 3.5million Muslims in the U.S. Wahed currently serves more than 200,000 customers from the UK and Malaysia. It uses Synctera’s offerings for its Bank Account and Wolf products. An app that links to her debit card program for American Muslims. TechCrunch was told by a spokesperson for Synctera that “One currently offers halal investments, regulated in accordance with applicable Islamic principles, standards, and to US clients.” One will now be able to offer its clients bank accounts (making money transfers faster and more seamless) as well as debit cards (for easy access to funds). ” We’re really excited to help Wahed launch banking products for its US customers…and expect to see a wave of mission-driven companies like Wahed adopt Incorporated banking services to help people improve their financial futures.” In recent years, we’ve seen more and more fintech companies shape their offerings to cater to very specific demographics like Hispanics, Blacks, Asian Americans, and immigrants in general. It will be interesting to see if this specialized focus pays off.

Boston-based companies are best in this context. Mendoza Ventures– which is described as a “Fintech and AI Venture Capital Firm Founded By a Latino and Female” She announced that she had achieved the first close of her $100 million fund – Third. Unfortunately, the company will not share the amount it raised but released a press statement saying that the fund will “prioritize investments in early growth stage startups with an accent on diverse founding teams.” We are always available to help with any initiative that aims to raise the profile of diverse founding teams. Bank of America led the first closing, which also included participation from Grasshopper Bank, and other unidentified investors.

To start the year Felicity VenturesVictoria Treasure Bent, Managing director another guestTechCrunch, where she gives her predictions as well as where she sees opportunities within the financial technology industry. Bessemer Venture Partners will continue to be available. Charles Birnbaum He told us via email that he believes that “with FedNow finally set for a broader launch in mid-2023, all eyes will be on opportunities related to faster payments. Although Clearing House’s RTP program has been adopted in a moderate manner, FedNow will use FedLine’s existing network to accelerate payment adoption beginning in 2023. There will be ample opportunities to build the enabling infrastructure for use cases such payroll, supplier payments, and other payments. He remains optimistic about the institutional adoption of blockchain technology in large areas of financial services. For example, he predicts that SWIFT “will continue to experiment with central bank digital currencies (CBDCs) while more banks join the USDF consortium to facilitate compliant transfer of value across blockchains via bank-granted stable deposit digital currencies.”

Blockchain is the future. Mercurio, a crypto-focused startup that has built a cross-border payments network, has now launched a BaaS solution, which it claims “unlocks a unique feature — the ability to manage cryptocurrency and bank accounts within a single platform.” A spokesperson for the company told me via email that the goal is to make it easier for traditional banks to open crypto accounts for their users and to give crypto platforms a way to open bank accounts that allow their customers to store, transfer and pay in fiat. / encryption. Company covered uploadIn June 2021.

It was wonderful to visit the startup whose salary and I covered last year, called A. Time is the best invention of 2022. Altro It raised $18 millionLast May, the startup expanded its offering to help people build credit using recurring payment options like digital subscriptions for Netflix, Spotify, Hulu, and Spotify. I admire the startup’s credit-building efforts. It is challenging the American credit score model.

Last week, Daryl Etherington & Becca Szkotak teamed up BrixHenrique Dubugras is the co-founder and co-CEO He talked about why he and his co-founder, Pedro Franceschi, decided to launch a corporate card companyThese are the reasons why the friends, who met online as teenagers and decided to co-CEOs among other things.

The Pay Transparency Tracker MassAnd RibbonShe is not transparent about her salary ranges. The financial technology company does not include salary ranges. CaliforniaOr New York City vacancies. The tracker also found that the CEO of Strategic Accounts at fintech startup Bolt can do just that — are you ready for it? – $374,000 to $462,000 OTE/yr(If I can be seen, you’ll see me making Kevin’s shocked face in “Home Alone” right now.

Manish Singh also reported: “Sohail Sameer, CEO, Spiceswill leave the top role later this week as the Indian fintech startup races to steer the ship after its founder was fired last year for allegedly misusing company funds.”Read More here.

Credits for the image: green light

Finance and Mergers and Acquisitions

TechCrunch’s Manish Sharma reports that India has seen two significant increases in fintech in recent weeks.

Indian fintech Money View is valued at $900 million in new funding

Indian fintech Kreditbee is close to $700 million in new funding

In South Korea, fintech Toss has seen its valuation rise to $7 billion.

South Korean stellar financial app Toss closes $405M Series G with valuation up 7%

Other financing deals that have been reported on the TC website include:

Gynger went undercover to loan companies cash in exchange for software

Fintech Vint hopes to turn wine and spirits into a major asset class

Early-stage Mexican fintech Aviva offers loans as easy as a video call

And other places:

Saudi startup Manafea raises $28 million to fund expansion

This is a file. Although I’m not a resolution expert, I can say that I am. MorningTo start the year on a positive note. Although the past year was difficult in many ways, it doesn’t mean that you should be negative or pessimistic. There are still many good news stories and things to be thankful for. So, my wish is for 2023 more resilience and optimism for everyone. While we can’t control everything, we can try to be more resilient. canControl how we interact. We appreciate your support and thank you for reading. I’m always available for feedback! I hope you have a wonderful week!

Source link

[Denial of responsibility! reporterbyte.com is an automatic aggregator of the all world’s media. In each content, the hyperlink to the primary source is specified. All trademarks belong to their rightful owners, all materials to their authors. If you are the owner of the content and do not want us to publish your materials, please contact us by email – reporterbyte.com The content will be deleted within 24 hours.]