INTRODUCTION

In the previous year numerous analyst and others in the realm of financial aspects have anticipated a recession. After numerous long periods of bull market, investors worried about this chance may suddenly start searching for an approach to move their interests into more steady safe havens.

The conventional move is support against stock instability with gold. This has demonstrated a successful technique before, however a fresher option is testing the old fashioned safe havens. In 2009, bitcoin introduced another time of computerized monetary standards. As the main digital money, the only part of Bitcoin that can be described as centralized is it’s codebase. Before investing in bitcoin understanding of codebase meaning and codebase technologies is extremely important.

Bitcoin has a large number of build servicesof cash in the form of build servicesonline, yet for certain extraordinary provisions that could make it a reasonable asylum. At last, however, it stays up to the individual investor to decide whether bitcoin is a reasonable place of refuge in the midst of market inconvenience.

Bitcoin is blockchain-based digital money which provides pooled security (it is just like social security pooled trust) and imparts a few properties to its gold partner.

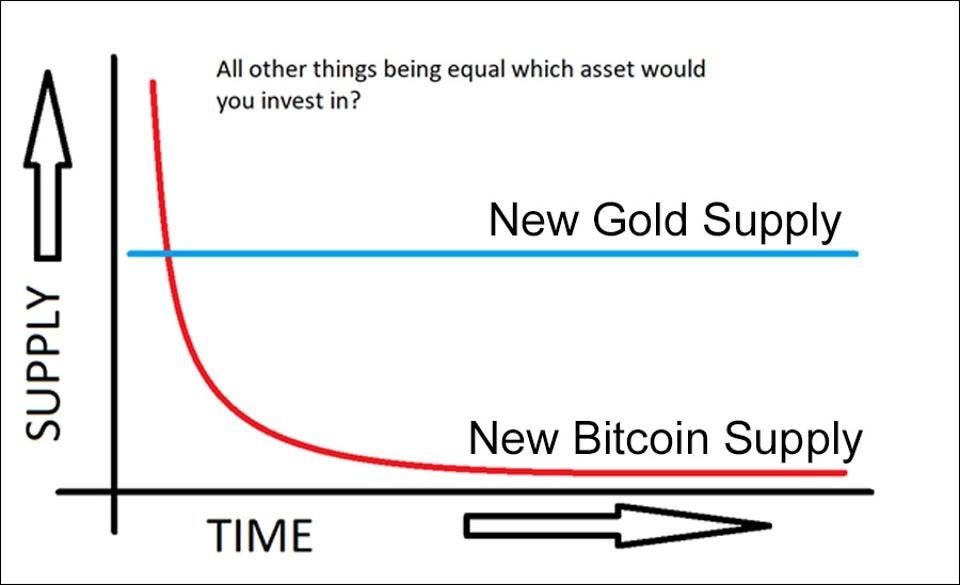

The supply of Gold and Bitcoin compared over time

1. STRAIGHTFORWARDNESS, SAFETY, LEGALITY

Gold set up framework for exchanging, measuring and tracking. It’s extremely difficult to take it, to pass off fake gold, or to in any case ruin the metal. Bitcoin is additionally hard to ruin, on account of its encoded, decentralized framework and difficult calculations, yet the foundation to guarantee its security actually should be created. On the other hand if you want to get a grant in the form of extended pooledsecurity, build services along with bonds oo7 , Substrate building (substrate meaning and substrate synonym here is foundation for Polkadot and a standalone blockchain framework)will allow you to build and launch a blockchain quickly with versatile features available for a wide range of project needs.

2. RESTRICTED STOCK

“Like gold and other valuable metals, Bitcoin infers quite a bit of its worth from its restricted stock and developing customer interest, both gold and bitcoin are uncommon assets. The splitting of Bitcoin’s mining reward guarantees that every one of the 21 million Bitcoin will be out available for use continuously 2140. While we realize that there is just 21 million bitcoin that exist, it is unclear when the entire world’s gold will be mined from the earth.

3. BOTH HAVE SET NUMBER OF UNITS

Different countries offer grants to its residents, individuals who get a grant to start a business has the best opportunity in the form of digital currency investment. Bitcoin has a limit all things considered since the quantity of units that will circle is restricted to 21 million, it is normal that continuously 2140 it will have completed the process of mining and no more Bitcoins will be created, this trademark is basically the same as gold, which likewise has a set number of units in the world.

4. PATTERN VALUE

Gold has truly been utilized in numerous applications; bitcoin has gigantic pattern esteem also. Billions of individuals all throughout the world need admittance to banking system and conventional method for finance like credit. With bitcoin, these people can send good opinion across the globe for near no charge.

5. LIQUIDITY

Both gold and bitcoin have extremely fluid business sectors where fiat cash can be traded for them.